When it comes to running a business, protecting your most valuable asset—your employees—is paramount. Workers’ compensation insurance is not just a legal requirement in many areas; it’s also a safety net for both employers and employees alike. But with so many options out there, how do you find the best workers comp insurance that fits your needs? At Aupeo.com, we’re here to guide you through every step of this essential process. Whether you’re a seasoned employer or just starting out, understanding workers’ comp can make all the difference when it comes to safeguarding your workforce and keeping your business flourishing. Let’s dive into the world of best workers comp insurance aupeo.com and explore what makes it so crucial for everyone involved.

Understanding Workers Comp Insurance

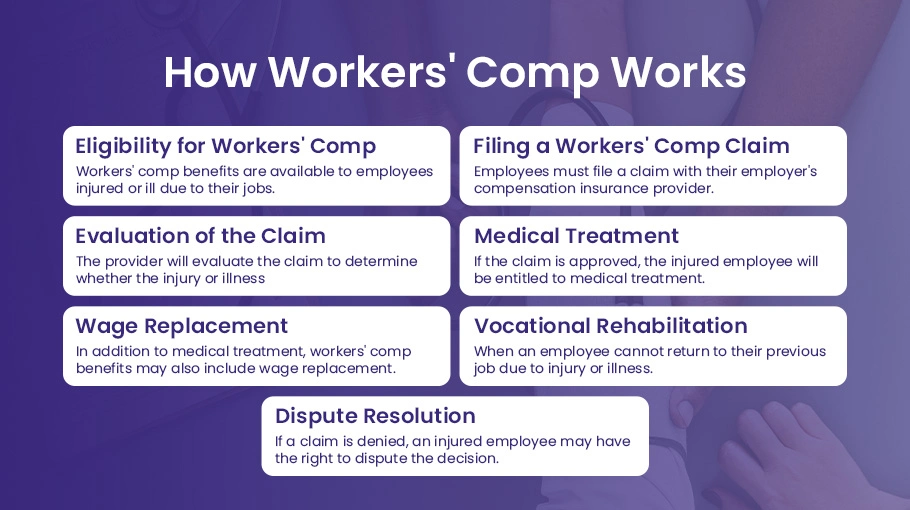

Workers’ compensation insurance is designed to protect employees who suffer work-related injuries or illnesses. It provides essential benefits, such as medical expenses and wage replacement, ensuring that workers can recover without facing financial ruin.

This type of insurance serves as a crucial safety net for employers too. By having coverage in place, businesses can reduce their legal liability if an employee files a claim due to workplace incidents.

Understanding the nuances of workers comp involves knowing your jurisdiction’s laws. Each state has specific regulations regarding coverage limits and eligibility criteria.

It’s also important to recognize that not all policies are created equal. Different industries may require tailored approaches based on unique risks and job functions.

Navigating this complex landscape might seem daunting, but grasping the basics sets you on the right path to making informed decisions about your business’s protection strategies.

Types of Coverage Offered by Workers Comp Insurance

Workers compensation insurance provides various types of coverage tailored to protect both employers and employees. One primary type is medical benefits, which covers the cost of treatments for work-related injuries or illnesses. This includes hospital visits, rehabilitation, and even prescription medications.

Another essential aspect is wage replacement benefits. If an employee cannot work due to a job-related injury, this coverage helps replace a portion of their lost income during recovery.

Employers also benefit from liability protection through workers comp policies. This protects them against lawsuits related to workplace injuries, safeguarding their financial stability.

Additionally, some plans offer vocational rehabilitation services. These assist injured employees in returning to work by providing training or support for transitioning into new roles if necessary.

Understanding these diverse coverages ensures that businesses can choose policies that best suit their needs while prioritizing the well-being of their workforce.

Benefits of Having Workers Comp Insurance for Employers and Employees

Having workers comp insurance is crucial for both employers and employees. For employers, it provides a safety net against costly lawsuits resulting from workplace injuries. This protection not only shields assets but also ensures compliance with state regulations.

Employees benefit significantly as well. In the event of an injury, they receive medical care and compensation for lost wages without needing to prove fault. This peace of mind fosters a better work environment.

Additionally, when companies prioritize employee safety through this coverage, morale often improves. Workers feel valued and secure in their roles, which can enhance productivity and reduce turnover rates.

Investing in workers comp insurance demonstrates commitment to staff welfare. It builds trust and enhances the employer’s reputation within the industry—an invaluable asset that attracts top talent.

How to Choose the Best Workers Comp Insurance Provider

Choosing the right workers comp insurance provider is crucial for your business. Start by assessing their reputation in the industry. Look for reviews and testimonials from other employers.

Next, consider their financial stability. A strong insurer will have a solid track record of paying claims without delays or complications. Check their ratings with agencies like A.

M. Best or Standard & Poor’s.

Don’t overlook customer service quality. You want a provider that is responsive and helpful, especially during stressful claim processes.

Evaluate coverage options too. Some providers may offer additional services such as safety training programs or risk management resources, which can be beneficial for your workplace.

Ensure they understand your specific industry needs to tailor the policy accordingly. This personalized approach can make all the difference in securing comprehensive protection for both you and your employees.

Factors to Consider when Comparing Quotes from Different Providers

When comparing quotes for workers comp insurance, start by evaluating coverage limits. Not all policies offer the same level of protection. Look closely at what each quote includes and excludes.

Next, consider deductibles. A lower deductible might lead to higher premiums but could save you money in the long run if a claim arises.

Examine customer service ratings as well. Responsive support can make a significant difference during stressful claims processes.

Additionally, investigate any additional services offered. Some providers include risk management tools or loss prevention programs that could benefit your business.

Don’t overlook the insurer’s reputation in the industry. Research reviews and testimonials to gauge their reliability and responsiveness over time. Taking these factors into account will help you find not just a competitive price but also peace of mind with your choice.

Tips for Saving Money on Workers Comp Insurance Premiums

Saving money on workers comp insurance premiums doesn’t have to be complicated. Start by fostering a safe work environment. Fewer accidents mean fewer claims, which can lead to lower rates.

Another effective strategy is to regularly review and update your coverage. As your business evolves, so do its risks. Ensure you’re not over-insured or under-insured for the current needs of your company.

Consider implementing a robust employee training program as well. Educated employees are less likely to make mistakes that could result in injuries, thus potentially reducing claims.

Don’t hesitate to shop around for quotes from different providers. Some may offer discounts or tailored packages that better suit your industry’s specific needs.

Maintain an open dialogue with your insurance agent. They can provide insights into ways you can optimize coverage while minimizing costs based on current trends and changes in regulations.

Conclusion

When it comes to choosing the best workers comp insurance, understanding your options and what they entail is crucial. Workers’ compensation insurance serves as a safety net for both employers and employees, ensuring that everyone has peace of mind in case of workplace injuries or illnesses.

By exploring different types of coverage, you can tailor a policy that fits the specific needs of your business. The benefits extend beyond compliance with legal requirements; it fosters a safer work environment and enhances employee morale. Employers who invest in comprehensive coverage often find themselves at an advantage when attracting talent.

Selecting the right provider requires careful consideration. Look for those with strong reputations and excellent customer service records. Compare quotes diligently while keeping an eye on key factors like policy limits, deductibles, and additional services offered.

Cost savings are also attainable through various strategies such as increasing safety measures within the workplace or opting for higher deductibles if feasible.

Choosing wisely will not only protect your business but also nurture trust among your team members—making it clear that their well-being is a priority. By taking these steps, you position yourself to secure some of the best workers comp insurance available today at best workers comp insurance aupeo.com empowering both your workforce and business growth.