Introduction

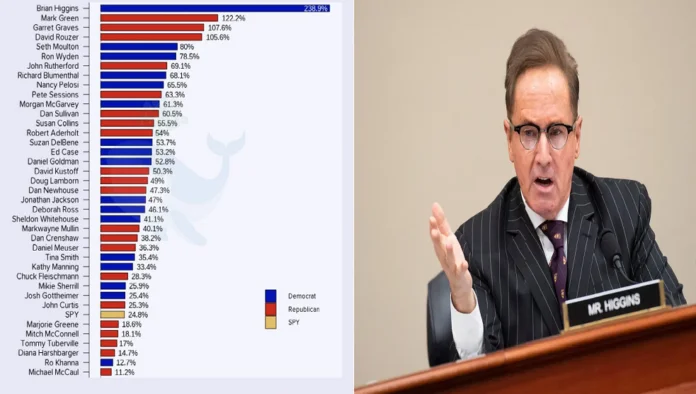

Navigating the complex world of stock trading can be daunting, but learning from successful traders can provide invaluable insights. One such is Brian Higgins Stock Trades, whose strategies and trades have garnered significant attention. This comprehensive guide delves into his stock trading practices, offering a detailed analysis that can help you refine your own trading approach.

Understanding Brian Higgins’ Trading Philosophy

Brian Higgins is not just a trader; he’s a strategist who approaches the stock market with a blend of technical and fundamental analysis. His investment philosophy is rooted in thorough research and a deep understanding of market dynamics. By studying his trades, we can uncover the principles that guide his investment decisions and contribute to his success.

The Importance of Research and Analysis

A cornerstone of Higgins’ trading success is his commitment to extensive research and analysis. He meticulously studies market trends, company performance, and economic indicators before making any investment. This dedication to understanding the market landscape enables him to make informed decisions that maximize returns and minimize risks.

Technical Analysis: Predicting Market Movements

Technical analysis is a key component of Brian Higgins’ trading strategy. By examining historical price data and trading volumes, Higgins identifies patterns that suggest future market movements. This method allows him to pinpoint optimal entry and exit points, enhancing the precision of his trades. His use of technical indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) helps him stay ahead of market trends.

Fundamental Analysis: Assessing Intrinsic Value

While technical analysis focuses on market patterns, fundamental analysis evaluates a company’s intrinsic value. Higgins scrutinizes financial statements, revenue growth, profit margins, and other key financial metrics to assess a company’s health and potential for future growth. This approach ensures that his investments are backed by solid, long-term prospects rather than short-term market fluctuations.

Diversification: Spreading Risk

Brian Higgins emphasizes the importance of diversification in his investment strategy. By spreading his investments across various sectors and asset classes, he mitigates risk and enhances the stability of his portfolio. Diversification protects against significant losses from any single investment, ensuring steady growth over time. This strategy is particularly useful in volatile markets, where individual stocks can experience rapid changes in value.

Higgins’ Decision-Making Process

Higgins’ decision-making process is a blend of art and science. He combines quantitative analysis with qualitative insights to make well-rounded investment decisions. For instance, he may look at a company’s financial metrics while also considering industry trends, management quality, and competitive positioning. This holistic approach helps him identify undervalued stocks with strong growth potential.

Case Study: Brian Higgins’ Notable Trades

Examining some of Brian Higgins’ notable trades can provide practical insights into his strategies. One significant trade involved investing in a tech company poised for growth due to its innovative products and strong market position. Higgins’ analysis predicted a surge in demand for the company’s offerings, and his timely investment resulted in substantial returns as the stock price soared.

Another example is his investment in a healthcare firm during a period of industry consolidation. Higgins recognized the firm’s potential for acquisition, which would likely drive up its stock price. His foresight paid off when the firm was acquired, leading to a significant profit on his investment.

Learning from Mistakes: A Crucial Aspect of Trading

Even successful traders like Brian Higgins have their share of mistakes. What sets him apart is his ability to learn from these errors and adapt his strategies accordingly. Higgins regularly reviews his trades to understand what worked and what didn’t. This continuous learning process helps him refine his approach and stay ahead of the market.

Adapting to Market Conditions

The stock market is constantly evolving, and so are Higgins’ strategies. He adapts to changing market conditions by staying informed about global economic trends, geopolitical events, and technological advancements. This adaptability ensures that his investment strategies remain relevant and effective in different market environments.

Risk Management: Protecting Investments

Effective risk management is crucial in stock trading, and Brian Higgins excels in this area. He employs various risk management techniques to protect his investments, such as setting stop-loss orders, diversifying his portfolio, and maintaining a balanced risk-to-reward ratio. These measures help safeguard his investments from significant losses while allowing for potential gains.

Building a Resilient Portfolio

Higgins’ approach to building a resilient portfolio involves selecting a mix of defensive and growth stocks. Defensive stocks, like those in the utilities or consumer staples sectors, provide stability during market downturns. Growth stocks, on the other hand, offer higher returns during bull markets. This balanced approach ensures that his portfolio can withstand market volatility and continue to grow over time.

The Role of Patience and Discipline

Patience and discipline are key traits of successful traders, and Brian Higgins embodies both. He avoids impulsive decisions and sticks to his well-researched strategies. This disciplined approach helps him stay focused on long-term goals rather than getting swayed by short-term market fluctuations.

Conclusion: Applying Higgins’ Strategies to Your Trading

In conclusion, Brian Higgins Stock Trades strategies offer valuable lessons for investors at all levels. His emphasis on thorough research, technical and fundamental analysis, diversification, and risk management provides a robust framework for successful trading. By adopting these principles and remaining adaptable, you can enhance your trading skills and achieve greater success in the stock market. Remember, the key to successful trading lies in continuous learning, discipline, and a strategic approach.